5 Byron Street, Mackay

Welcome

Welcome to the marketing Campaign for 5 Byron Street, Mackay.

Should you have any questions at all beyond what is available in this document, please do not hesitate to get in touch with me.

Kind regards,

Wendy Pollock

M : 0419 775 418 E : wendy.pollock@fnrealty.com.au

Property Features

2 |

1 |

1 |

764 sqm |

5 Byron Street, Mackay QLD

Key Features:

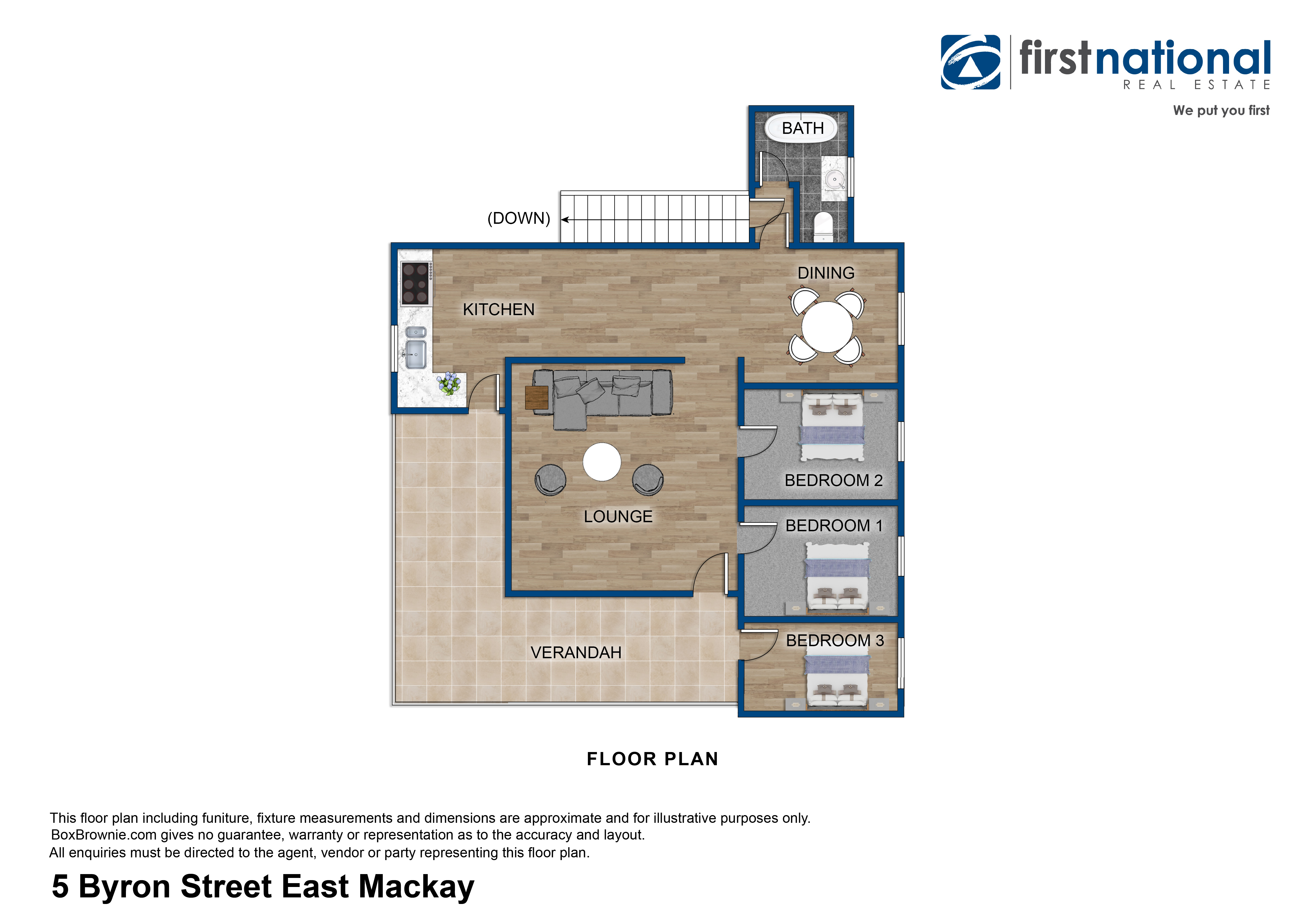

* 3 spacious bedrooms, including a traditional sleepout

* Air-conditioning and new fans for year-round comfort

* Updated kitchen with generous storage space

* New floor coverings throughout

* Single shed set on a generous 764sqm allotment

This property is a fantastic opportunity to enter the market and

complete renovations and own your own piece of history.

Location Highlights:

* Just moments from Queens Park, schools, beaches and shopping

This property is a fantastic opportunity for first-time homebuyers, renovators, or developers. Plus, with the neighboring 3 Byron Street also on the market, you have a rare chance to secure a substantial block on the edge of Mackay's CBD. Please note this property is currently tenanted.

For your personal appointment, please make contact with Wendy Pollock 0419 775 418 or Melany Pollock 0409 420 105.

Disclaimer: The Agent does not give any warranty as to errors or omissions, if any, in these particulars, the provided information from the Vendor can be deemed reliable but not accurate. Any persons interested in the property should conduct their own research.

5 Byron Street, Mackay QLD

3D Virtual Tour

Floorplan

Property Photos

Photo Gallery

Google Map - Property Location

Map

Suburb Profile

$594,000

$400,000

33

37

45

168

9

23

695

921

$550

$480

21

18

5.57%

7.62%

36

191

5

31

291

635

Purchasing Steps

6 STEPS TO BUYING A HOUSE

Purchasing residential real estate can be a very exciting process, however it can also be a confusing time for the prospective buyer. As you may already be aware, different agencies usually have different sets of rules and standards, so we would like to inform you of the general buying process.

Property owners receive all types of interest - some genuine, some not. Some people submit offers to test the possibility of sale, but do not actually stay true with their offer.

This can lead to frustration and concern for the owners as they try to assess who is actually a genuine buyer. The best way to present a strong offer on any property is to follow the steps below that allow you to understand what is required in preparation

Allowing you to put forward your strongest purchasing proposition to the agent. All offers must be presented to the owner in writing and all purchase details correct for filling in the contract for signing.

STEP 1 - PROVIDE AGENT WITH YOUR FULL DETAILS SUCH AS:

- Your full name (including any middle names) and contact details.

- The actual purchase price you will be paying for the property.

- The amount of sale deposit you intend to pay (this can be an amount up to but not more than 10% of the purchase price).

- The settlement period that you require or the vendor has stipulated.

- The name of your chosen Conveyancer.

- The name of your bank or financial lending institution.

- Any special conditions or requests that you may have so that we can inform the vendor (property owner).

STEP 2 - CONFIRM YOUR TIME FRAME AVAILABLE TO DO ANY INVESTIGATIONS

Find out if the property has a deadline on it, such as auction or other offers from interested parties.

STEP 3 - DECIDE IF YOU ARE GOING TO OBTAIN A PEST & BUILDING REPORT

Before you purchase any property - in particular a new home it is important that you receive a copy of a Pest and Building Report from a qualified inspector. Please note that this report is a complete list of defects of the home, and is very different from the feature brochure that you receive from our agency. Most people are shocked with the report they receive on the home and most times misinterpret the report, e.g. the home is 34 years old and is in need of new roof tiles. Roof tiles last approximately 35 years and need replacing on every home of that age. The point to remember here is that all homes at one time or another require maintenance, and that this is known as a capital improvement.

STEP 4 – NOTIFY YOUR BANK OF YOUR PURCHASE ADDRESS & DETAILS

A pre-approval of finance from your bank or lending institution needs to be in place before safely proceeding with your property purchase, however many banks will approve you in principle yet may require a valuation. Don’t be alarmed if your bank or lending institution request a valuation by a registered property valuer. This is normal practice of lending institutions, and serves as confirmation of the agreed sale price. If you are intending to buy at auction, all the above-mentioned must be in place. Auction day is final. If you turn up to bid and you are the highest bidder past the reserve price (on-the-market price) you are the instant owner awaiting settlement of the property.

STEP 5 – DON’T FORGET TO INCLUDE STAMP DUTY FUNDS IN YOUR FINAL NUMBERS

STEP 6 – MEET WITH THE AGENT AND PROVIDE ALL DETAILS FOR SIGN OFF WITH THE OWNER

An offer to purchase a property will usually require for you to sign a contract so that the offer can be presented to the Seller 'in writing'. The contract will not be deemed fully signed until the agreement of price and conditions is reached by both parties, any changes to the initial offer will need to be initialed before a Contract is dated. Once agreement on price, settlement, conditions, etc has been reached with the vendor the sale can proceed.

An exchange of contracts is the only way to actually buy or sell real estate. This is achieved by signing the contract of sale which is then processed by the agent with all legal parties.

IN SUMMARY

Preparation is the key. Understand the steps of sale and have everything in place is imperative to reaching your property goals. Whether you are considering purchasing this property or another in the near future and in need of advice, please feel free to contact myself or any of our team with questions that you may have.

We are available to assist you.

Purchasing a property through First National Mackay, Sarina & Nebo

Purchasing residential real estate can be a very exciting process, however it can also be confusing time for the prospective buyer. As you may already be aware, different agencies usually have different sets of rules and standards, so we would like to inform you of the buying process should you decide to purchase a property through First National Mackay, Sarina & Nebo.

Should you decide to make an offer on one of our listed properties, we will ask you to confirm the following details, enabling us to help you in the best possible way.

- The actual purchase price you will be paying for the property

- The amount and method by which you choose to pay the deposit, e.g. cheque/cash/bond/other

- The settlement period that you require

- The name of your chosen solicitor or conveyancer

- The name of your bank or financial lending institution

- Any special conditions or requests that you may have so that we can inform the vendor (property owner).

Once we have the above information on a signed contract, we are in a position to arrange a meeting with the vendor and present your offer.

Tip

Property owners receive all types of interest – some genuine, some not. Some people submit verbal offers to test the possibility of a sale, but do not actually stay true with their offer.

This can lead to frustration and concern for the owners as they try to assess who is actually a genuine buyer. The best way to present a strong offer for the purchase of property is to make it on a formal contract document. A verbal offer is not legally binding and should not be relied upon by either party. This clearly demonstrates to the vendor that you are serious about your offer. Please be aware that when you sign a contract to purchase real estate in Tasmania there is no cooling off period.

Also be aware that if making an offer, never assume that your agent or the property owner will come back and forth to you – and you should take the approach that your first offer may be the only opportunity you get to obtain the property. A willing seller may not wish to wait around and may accept a reasonable offer from another buyer.

Once an agreement on price, settlement, conditions, etc has been reached and signed by all parties, the sale can proceed.

Option 1: unconditional contract

An unconditional offer is when you offer an amount to buy the house as listed (with or without drapes, fixtures, etc) without adding or negotiating any other conditions and makes both parties committed to an instant, legally binding relationship. There is no turning back.

Option 2: conditional contract

A conditional offer is when you offer to buy the property only if certain conditions are accepted by the vendor. These must be listed on the Contract of Sale. For example, your offer may be conditional on arranging finance. If finance cannot be arranged within a certain period of time or the amount you require to complete the purchase, the offer becomes void. For your own protection, you should nominate a specific lender as your source of finance. Leaving out a nominated lender or having open-ended finance conditions on the contract may force you to take up finance at substantially higher rates, perhaps shorter terms, and from a lender you would not prefer to deal with.

If you are wishing to seal a deal, it is important that you understand the commitment level required by both the purchaser and vendor.

General Tips

If you want to make an offer, be certain that you can follow through by having the following items confirmed:

- A pre-approval of finance from your bank or lending institution

- Your own property sold, or at least assessed for value and possible sale time

- You have a solicitor or conveyancer selected

- Determine how you will be paying the deposit and associated costs eg stamp duty

- An idea of settlement times required before you take possession.

Building reports

Before you purchase any property it is important that you consider organizing a building report from a qualified building inspector so you know if there are any structural defects with the property and what they might cost to fix. This will be at your expense and can vary anywhere from $500-$800. We recommend if you proceed with a building inspection that you make it a condition in the contract. Most people are shocked with the report they receive on the home, and most times misinterpret the report, e.g. the home is 24 years old and … is in need of new roof tiles. Roof tiles last approximately 25 years and need replacing on every home at that age. The point to remember here is that all homes at one time or another require maintenance, and that this is known as a capital improvement on the property.

Summary

Preparation is the key. Understand your rights and have everything in place. If you follow the advice in this document and First National Real Estate’s Home Buying Guide, along with that of your solicitor/conveyancer and your First National Burnie agent, you will be on your way to securing the right property for you. Whether you are considering purchasing property in the near future, or are currently in the process of buying a property through another company and in need of advice, please feel free to call any of the First National Burnie sales team with any questions that you may have. We will be happy to assist you.

(Please keep this information on file, you will find it helpful during the sales process as a reference guide).

Property Management Services

Of most importance are the following questions:

- “How do I ensure my Property is managed to its full potential?

- How do I maximise the return on my investment?

- How soon can I expect a suitable Tenant renting my Property?”

The First National Real Estate Property Management Team will answer these very important questions for you when introducing you to their Property Management Services.

Whether you have a single investment Property or a Portfolio our flexible fee structure and Personal Management Plan is backed up by our written Service Guarantee. You stand to benefit significantly.

Please feel free to call me to arrange an obligation free presentation of our services.

Mobile 0417 321 227

Email kristy.surman@fnrealty.com.au

Do you currently own an investment property?

If so, we can provide you with important information from our investor support service including the current rental environment in our market.

We would love the opportunity to discuss how we are currently helping rental property owners maximise the return on their investments.

In the meantime, feel free to drop by our site and visit our Landlord Resources page as an introduction to our Property Management services.

We look forward to helping you further.

Kristy Surman

BUSINESS DEVELOPMENT MANAGER

Disclaimer

The information included in this eBook has been furnished to us by the Vendor of the property. We have not verified whether or not that information is accurate and have no belief one way or another in its accuracy. We do not accept any responsibility to any person for its accuracy and do no more than pass it on. All interested parties should make and rely upon their own enquiries in order to determine whether or not this information is in fact accurate.